Information is power.

The more you know about your business numbers, the faster (and more confidently) you can make decisions.

Of course, your gut instincts hold power too. There is reason to trust the intuition you’ve subconsciously built over years of making critical business decisions. Still, most decisions require hard data to confirm or challenge our instincts. And we live in an age where we can have that data at our fingertips.

When Xero is used well it powers better business decisions. Your Xero is a living, breathing information hub. It’s where you can get the most up to date data on how your business is performing.

We say ‘used well’ because anyone can subscribe to Xero and get the default view of information it provides. We’ve realised clients are often reluctant to go into their Xero account and mess with the settings. But actually you can make your Xero account a lot more personalised when you know how.

You can do a lot of tailoring in Xero to make it specific to your business

Xero is a sophisticated bit of software. As a Xero user, the most important thing you can do for your business is set it up to provide you with the information you most need. You want to be able to pick the numbers that will help you understand how your business is performing, so you know what steps to take next. The good news is: you can!

When you start a Xero account, or have one set up for you, Xero assigns a default chart of accounts. Your chart of accounts is a collection of all your company’s financial categories in one place, to help you keep track of your business transactions.

The default accounts work really well for some businesses, but not so well for others. If you aren’t getting the information you need, you can add completely different categories to the default, and call them whatever you like.

Setting up tailored accounts allows you to see your data in different ways

For our business, we’ve found setting up our own categories to be incredibly valuable.

In your default chart of accounts, you’ve got standard categories such as:

- Sales

- Salaries

- Rent

- Advertising & marketing

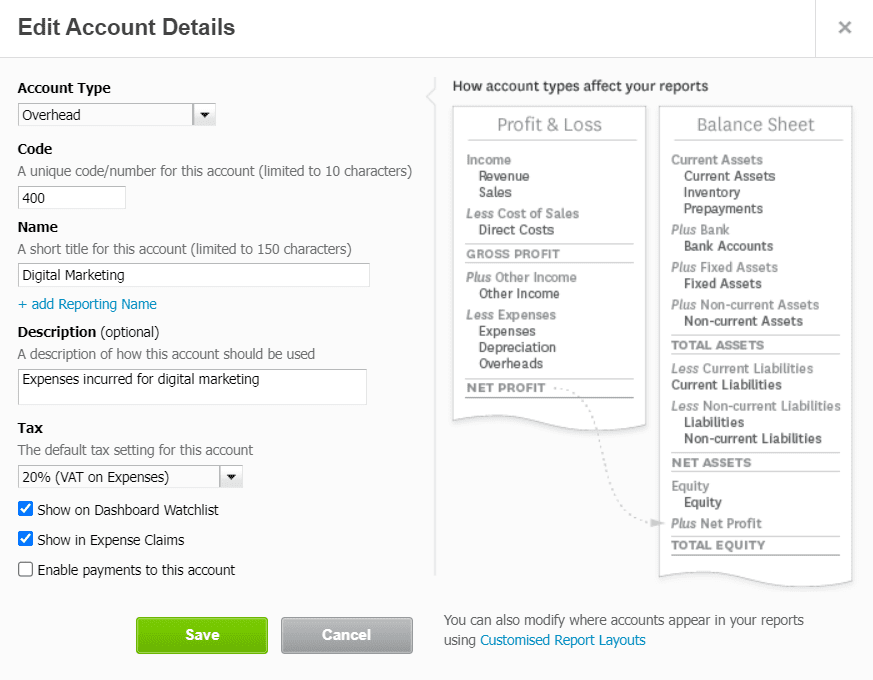

You can cut this data further by adding your own categories into the mix. Maybe you want to be able to keep an eye on how much you are spending on digital marketing, and keep it separate from your spend on PR. Xero lets you edit the account names, delete (or archive) ones you don’t need, and add brand new ones. So you could edit “Advertising & marketing” and change the name to “Digital marketing”, and add an extra account called “PR”. You can even tick to say you want to see that account on your dashboard watchlist so you can really keep a watch on it.

Tracking categories let you see the data a different way

A really underused functionality in Xero is “tracking categories”. They allow you to slice through the data in a different way. Keeping going with our marketing spend theme, lets say your business has two different divisions. Maybe you sell wedding dresses, and you also hire out prom dresses. You run different marketing campaigns for each division. How do you figure out which division is the most profitable?

That is exactly what tracking categories allow you to do. You could add one called “Division” and set up your two divisions, “Wedding dress sales” and “Prom dress hire”. Every sales, cost of sales, marketing transaction you then tag to one of the divisions. Xero then allows you to report on the profit by division. In my example below £2,000 was spent on marketing split equally between wedding dress sales and prom dress hire. Both have made a profit. But the profit on the wedding dress sales was much higher.

Why does that matter? Lets face it, many businesses are struggling at the moment with the cost of living crisis. Maybe next month this business really needs to make more money – one thing they could try would be to spend more of the marketing budget on the wedding dress sales, and then check and see what the results are. Just maybe that might mean a better overall profit.

Ultimately, you are giving your business a better chance of success. Chart of account codes and tracking categories don’t sound exciting, but they mean you get the information you need to move forward and not waste time.

Let’s say you have multiple different types of products. By tracking each product with it’s own categories, you find Product A and Product B are really profitable and Product C really isn’t. BUT you also know that Product C is taking up all of your time. With the data in front of you, you realise you’re best to kill off Product C and focus all your time on growing A and B.

With these Xero tricks you can get as granular as you like, to make the data view genuinely helpful.

Watch this video to see how to tailor make your own categories

Get help to provide the specific data you need for YOUR business

These little techy things in Xero can have a huge impact on your decision making ability. The video above guides you through how to set up the tracking categories to suit your needs.

Thing is, before the how you might be unsure of what it is you want to be tracking in the first place. What do you need to be seeing?

If you simply know you could be using Xero better, but you’re not sure how, our Xero health check is perfect for you. A Xero health check is available to you whether you’re a Starfish client or not. It gives you an expert pair of eyes on your data, helping you spot errors you might be making and opportunities you could be taking.

Explore the Xero health check service and see where you can make some quick wins for your business.