Rather than a necessary evil, bookkeeping is vital to the success of your business. You’ve chosen Xero because you know having the best technology on your side is going to make it far easier on you to get the bookkeeping done and see that success faster.

In the past, we’ve seen the good, the bad and the ugly when it comes to bookkeeping, even with business owners using Xero. Xero is pretty magic and some tasks can be automated, but your bookkeeping still needs to be done. You want to make sure you’re getting the best from it.

We have lots of experience under our belts to help you set off on the right foot, and avoid the common pitfalls and bad habits. Here are our six top tips.

1. Forming good habits from the outset will save you from overwhelm

You don’t want your bookkeeping to become a burden and cause you sleepless nights. For that reason, routine and consistency is the first and most important lesson when it comes to getting it done.

Decide whether daily, weekly or monthly bookkeeping will work best for you and then set aside the time to do it. Little and often is key to keeping in tune with your business, and you’ll be doing yourself a big favour if you clear queries whilst they’re fresh in your mind.

Having accurate accounts and the ability to identify what is and isn’t working can only be beneficial for you and your business.

2. Understand your accounting deadlines can save you from penalties

Do you know when your accounts and tax returns are due? What about your VAT returns? Get to know the key dates so you can set yourself up for success.

If you have a limited company you can check your year end date and filing deadline on Companies House. The self employed tax filing deadline is 31 January following the end of the tax year. If your business is registered for VAT under Making Tax Digital then link Xero to your online VAT account so that Xero can prompt you with your VAT filing deadlines. Don’t get caught out with penalties for late submission.

3. Upload expenses and bills using Receipt Bank as soon as you receive them

This saves you having to keep physical copies of all your receipts, whether it be in a shoebox, the car, or stuck down the back of sofa. It also means you won’t then have to go looking for them when it comes to tax return time. Receipt Bank is a business owner’s best friend. You simply snap a picture of your receipt or invoice so it’s stored digitally and securely for connecting with Xero.

If you’re VAT registered, make sure you get valid VAT receipts. You want to be able to reclaim every penny you’ve spent on VAT and you won’t be able to do that without the correct supporting documentation – nor will any accountant you’re working with. Having supporting documentation for every bank transaction is also best practice and may be something HMRC check up on.

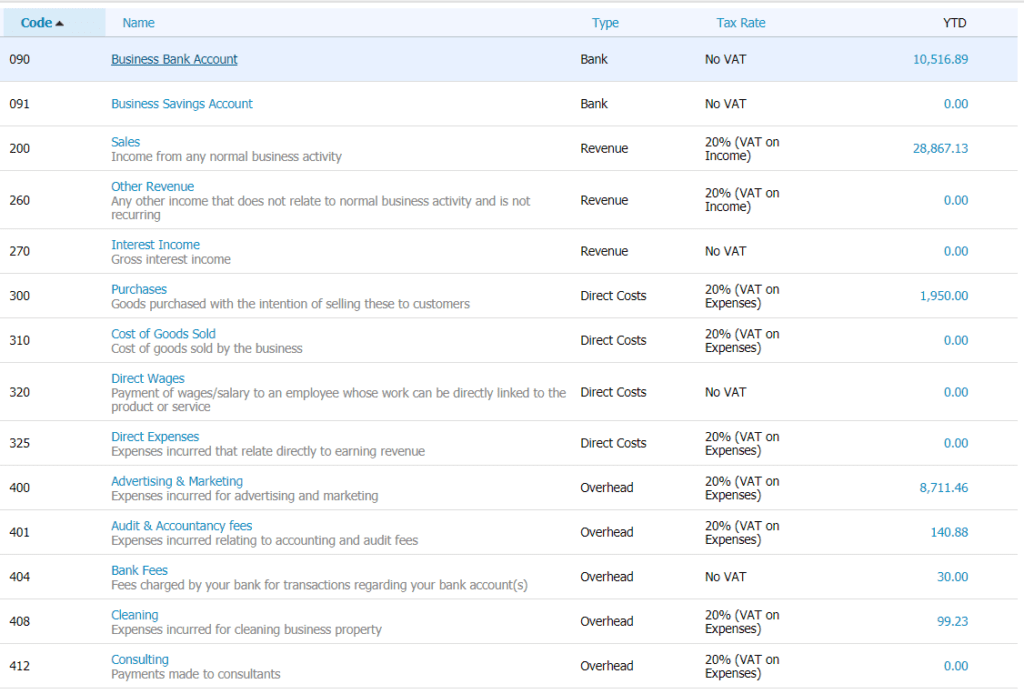

4. Be specific with your Xero bookkeeping categories so you get a clearer picture of your expenses

Do your chart of accounts categories reflect what your business does and what you’d like to track? This can be customised in Xero so that you can track different types of income and expenses. Avoid using the account “General Expenses”. Be more specific and you’ll get a much clearer picture of what you are spending on.

We highly recommend only putting business expenditure through your business account, and having a completely separate personal bank account. Mixing both business and personal in one account can be messy and time consuming to work through.

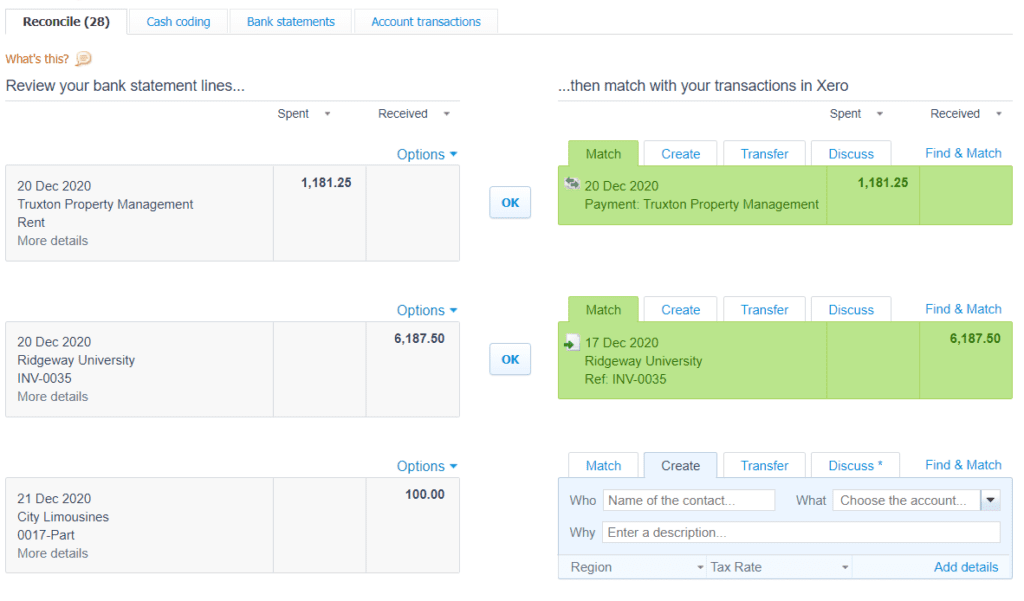

5. Reconcile your bank accounts regularly.

The process of bank reconciliation is matching a bank transaction (spend or money received) against a receipt, bill or invoice, or pushing transactions to different categories. Identifying a bank transaction early without matching backup is much easier to deal with when it is fresh in your mind.

Run a bank reconciliation report regularly to see if there are any unmatched payments or receipts. Are they duplicates or has the matching bank transaction not come through yet? Perhaps you’ve published to the incorrect account. Keeping on top of these discrepancies regularly will help you to avoid confusion and inaccuracies in your accounts.

Make it easier on yourself by:

- Setting up bank rules – sometimes it is beneficial to create a bank rule for a repeating transaction such as a standing order or direct debit. Set them up with care and they can be a great time saver.

- Activating a live bank feed from your bank account to Xero if possible – this will save the need to manually import statements and will update daily.

- Checking your bank balance in Xero against your actual bank balance – do they match? If they don’t, investigate why not.

6. Check your Aged Receivables and Aged Payables reports every month.

What does your Aged Receivables report (or Invoices Awaiting Payment) tell you? Who hasn’t paid you on time? Follow up with them for payment and keep an eye on late payment trends. You may need to change your payments terms or set up a credit control process.

What does your Aged Payables report (or Bills awaiting payment) tell you? Are you on top of paying your suppliers? Check if there items there you think you’ve already paid. It could be that you’ve sent a bill through twice or a bank transaction has been reconciled as a Spend Money when it should have been matched to the bill.

These are just some of the activities a bookkeeper would do for you

The final piece of advice from our collective bank of wisdom is to get the support of a bookkeeper early on. Don’t wait until it’s desperate times and you’re overwhelmed and overrun. Your time is valuable – so ask yourself whether you’d rather be spending your own time, or spending money on support.

These are just some of the monthly bookkeeping tasks we can take off your plate from the get go, so your time is always prioritised. If that’s something you’d like to talk more about, just pop your details in our contact form, we’d love to hear from you.